Have you ever wondered how the bank worked out how much interest to pay on your savings account, or charge you on your mortgage?

I had a mortgage with a building society some years ago, and their interest calculation was devastatingly simple: On 1st January, they took the balance owed, multiplied it by the mortgage interest rate, and debited the mortgage account with this sum in a single transaction. As you made repayments each month, they reduced the balance and by December the mortgage balance was a bit lower than at the same time last year, and the cycle started again.

Being interested in the process (and to be awkward, let’s be honest) I used to make a double payment in December so as to reduce the amount outstanding. This lowered my interest for the whole year and then I resumed monthly payments in February.

This led to some amusing conversations with the building society’s collections department when they called to ask why I had not made a repayment in January!

The formula for calculating interest is:

I = PRT/365

Where I is interest;

P is principal (ie the amount owed or in credit);

R is the interest rate; and

T is time, ie number of days.

So £100 at 5% for 6 months, say 180 days, gives you

(£100 x 5% x 180)/365

This comes to £2.46, which a sense-check says is about right, as £100 at 5% for a year will be £5.00.

Nowadays the banks have more sophisticated computer programs than my old building society, but you can still work it all out for yourself by hand, and in the old days this is how the banks did it:

If you take the formula I = PRT/365 and rearrange it you get:

I = PT x R/365

Every time you pay in or draw out, P changes and the number of days at each balance can also vary, so you get:

I = (P1T1 + P2T2 + P3T3 etc) x R/365

Or

I = ∑(PT)P, T, =1→n x R/365

Where ∑ means ‘the sum of’ for values of P and T from 1 to ‘n’.

So what you do is look at the balance and count the number of days and take the product of these two. Write it down and count the number of days again on the next balance, and multiply them and write that down. What you have is a list of products, or ‘Prods’ and you add them up.

Then, you take out a Prod book – remember, no pocket calculators in those days. This looked a bit like a log book, except the pages were headed up with interest rates, and you looked up the number of prods on the page for your interest rate and the value in the table was the amount of interest.

Today Prod Books have passed unlamented into history but you can do the same calculation of prods as above, then multiply by the interest rate and divide by 365 (366 if it’s a leap year).

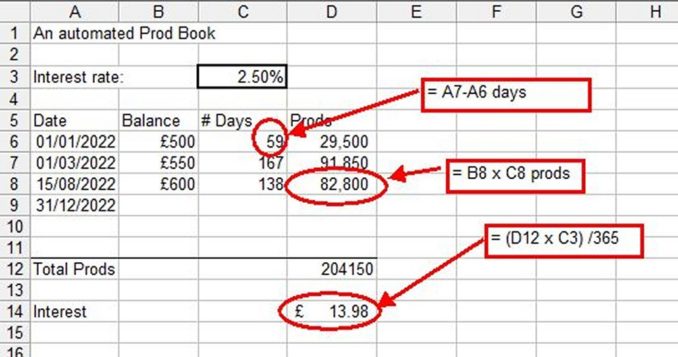

And, if you can work a spreadsheet, you can automate the whole thing, you just have to key in the dates and balances like this:

Over to you now – why not check your bank’s sums next time you get a statement?

Featured image: Nattanan Kanchanaprat from Pixabay

© Jim Walshe 2023