RuthAS, CC BY 3.0, via Wikimedia Commons

Many people are confused about inflation, unsurprisingly because politicians & Central Banks want you to be confused.

Let me give a few pointers, a quick glossary if you will.

Monetary Inflation

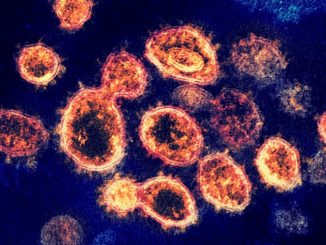

This is base camp for the inflation virus. Fiat currency is intrinsically worthless, simply paper or electronic. It is only of value if it is accepted generally & widely in exchange for goods & services, perhaps a store of value. In days of yore if paper money was backed by assets it retained its value, but but those days have long gone.

Recent history shows that when President Nixon finished the US $ gold backing to fund the Vietnam war in 1971 the purchasing power fell to today’s value of six cents. This happened because The Fed could print money at will, the massive growth in money supply simply will degrade the $ ad infinitum. The pound sterling, yen, euro & Swiss Franc are no exception. Money is simply manufactured to meet the needs of western welfare/warfare states. With a weird interpretation of democracy which is simply a head count of the adult population there is no political will to turn off the quantitative easing spigot. So monetary inflation continues apace. Indeed we now see the extraordinary concept of inflation at a preordained rate being a good thing. 2% was the Western global central bank’s target.

The problem is the inflation bug let out of Pandora’s box cannot be easily put back.

Price Inflation

Monetary inflation inevitably leads to price rises to reflect degraded money. Goods, services & wages shoot up.

Inflation feeds on itself crucifying pension funds & workers incomes without mercy. Only those in the public sector & the asset rich escape its venom.

To add fuel to the inflationary fire is debt. Western governments make no attempt to curtail public spending. Debt servicing becomes prohibitive so more debt & quantitative easing replace prudence. Cutting spending is never discussed in western political elections, indeed the very reverse. Voters are bribed with their own money at election time is an ever competing debate, MSM editorial comment always praises government spending, never prudence & debt reduction. So the merry-go-round continues.

Insane government energy policy has made cheap & reliable energy impossible. Energy is at the root of society’s basic costs, when it goes up everything goes up & the wealth creating sector suffers most.

Perpetual global warfare can only be paid for by degrading currencies. Which is why the first thing to go is stable money.

Nixon took America off the gold standard to fight the Vietnam war, but history shows it is an old ploy. Debt & asset backed currency is the first sacrifice of war, the dead & maimed come later.

Stagflation

How can this be? Surely price increase suppress demand thereby suffocating price inflation. How can economies decline yet prices rise? It is holy writ that Keynesian economics denies this phenomenon.

Let me explain with a personal anecdote.

We have a small holding with about a mile of hedgerow, the cost of the annual cutting has doubled in three years. In short it has become unaffordable. So what can we do?

Well, we have gone to cutting every two years. So the cutting team have half the work. Prices up work down.

Of course the public sector never feel the draft. Did you know in the furlough years the only people on full pay, the public sector got bonuses of £43 million shared out ?

Public sector pensions are index linked a system long abandoned by the wealth creating sector as unaffordable.

Early retirement is only an option for teachers, civil servants & the massive quangocracy.

Is There a Solution?

Yes. Massive cuts in public sector spending (no that isn’t austerity, bear in mind public spending sucks money out of an economy it does not put money in), quangos, NHS reform, overseas aid in any form, uncompromising immigration reversal, kill fake climate science, abandon index linked public pensions.

Return to asset backed currency. Cap public spending by statute to 15% of GDP.

No welfare payments for healthy under 65s, no work no eat.

Accompany all this with huge tax cuts & deregulation.

I know everyone will squeal & demand special favour.

But hear this, if we don’t society will collapse with all that entails. Major surgery now or watch the patient die.

For in depth graphics see godfreybloom.uk

20 Year Gold Price History in UK Pounds per Ounce