OK Puffins.

Shoulders back & full attention to the screen please.

Some questions for you…………..

Why are Western finances in such a dire state ?

Why are so many people struggling just to exist ?

Why is Climate Change and Net Zero being pushed on us so aggressively ?

Why did the whole world shut down over a virus that mainly kills the elderly and sick ?

Why the war in Ukraine, why the war between Israel and Palestine & now why the collapse of Syria ?

I’m going to postulate that the rising Energy Cost of Energy (ECoE) theory goes a long way to explain these events. the most likely to explain events around the world. For those Puffins not familiar with ECoE, its a term created by Dr. Tim Morgan, former Head of Research at Tullett Prebon, a noted intermediary in the wholesale financial and energy markets.

Dr. Morgan believes that there are two economies running in parallel. One is “the underlying ‘real’ or physical economy of products and services” and the other is a “financial economy of money and credit”. “Money has no intrinsic worth, but commands value only in terms of the material things for which it can be exchanged”. To better understand that concept, imagine yourself stranded on a desert island. No amount of money, whether that be coins, gold or crypto, would have the slightest value because there would be nobody with which to trade it with for food or water. So, “the financial economy is a proxy for the real economy, just as money and credit are proxies for the products and services for which they can be exchanged”. All economic output is therefore the product of surplus energy. But energy is also required to access and produce the energy in the first place. Whatever remains is surplus energy.

Dr. Morgan calls the energy needed to access energy the Energy Cost of Energy (ECoE). So Surplus Energy = Total Energy – ECoE.

ECoE is critical to prosperity. If ECoE goes up then using the equation above, surplus energy goes down meaning economic output goes down.

So, if the ECoE is going up, it explains a lot of the major events we have seen over the last 15 years, if not longer.

The post-war generation grew up assuming they would do better than their parents. They would have a better education, earn more, save more, have a better house, have better holidays and retire earlier and wealthier. Many comment nowadays, that Millennials and Gen Z don’t want to work as hard, they are too delicate and spend too much money on takeaway coffees, avocados and mobile phones. They say that this is the only reason why these generations won’t do better than their parents but they are wrong……… The real reason is that the post-war generation lived in a golden era where the ECoE was cheap. Cheap energy meant prosperity for the average person and prosperity meant free schooling, free university, final-salary pensions and a lot of money sloshing around to spend on holidays and housing. OK. Perhaps Millennials and Gen Z do drink too many coffees and own expensive phones but criticising this is similar to criticising the working class for buying a pint and some cigarettes. George Orwell commented on this in his book “The Road to Wigan Pier”.

“We may find the idea of tobacco and a pint disgusting, but it’s the only thing that makes life bearable for a miner when he gets home from work.”

This was during the economic depression of the 1930s and similar criticism was aimed at the working class. “Well if they can afford to throw away their money on booze and fags then of course they’ll never prosper”. Orwell observes that those with less money opt for flavoursome foods to find some small comfort in their difficult circumstances, contrasting this with the choices available to the wealthy.

“The ordinary human being would sooner starve than live on brown bread and raw carrots. And the peculiar evil is this, that the less money you have, the less inclined you feel to spend it on wholesome food. A millionaire may enjoy breakfasting off orange juice and Ryvita biscuits; an unemployed man doesn’t. … When you are unemployed, which is to say when you are underfed, harassed, bored, and miserable, you don’t want to eat dull wholesome food. You want something a little bit ‘tasty’. There is always some cheaply pleasant thing to tempt you.”

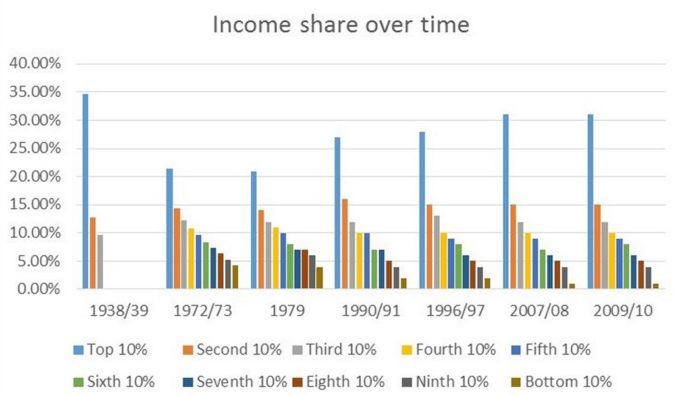

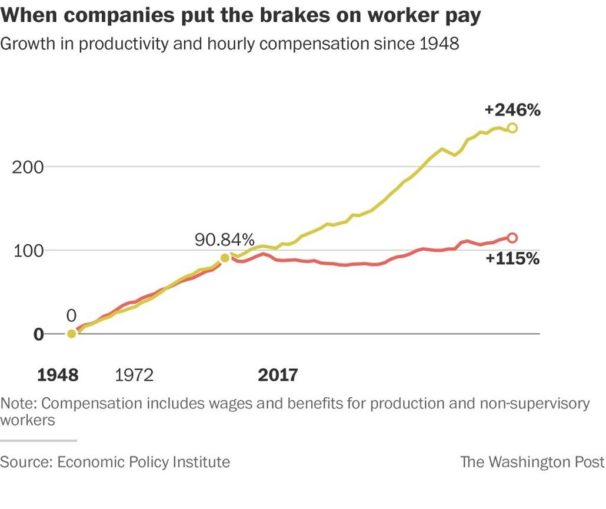

But is this decline in living standards really habbening ? The charts (for the U.S.) show that whilst profits have continued on a similar trend line, wages have stagnated since the Great Financial Crash in 2008.

Before then, with cheap ECoE, if profits rose, so did wages. However, since the GFC, it seems profits can only rise by shafting the workers. Following the peak of US oil production in the ‘70s, the cost of the West’s primary energy source shot up. This created the stagflation of the ‘70s and another oil shock – the Iranian revolution and the Iran-Iraq war – brought the inflation to an end in the early ‘80s. However, the energy problem never went away with the ECoE continually rising. This was masked by ever increasing government and private debt & the house of cards came to an abrupt end in the 2008 , when the curtain was pulled back and the Wizard of Oz revealed that the prosperity everyone had been enjoying had ended years ago. In short, the only way for profits to keep increasing was for wages to be crushed. Initially this was done by encouraging as many people as possible to go to university. Not only did this produce a glut of new workers but they also paid for their own social security via student loans. Another way to crush wages was with the massive expansion of low-paid retail and hospitality jobs. Mass immigration supplied these workers. Two economies were running in parallel as they still do today. One is “the underlying ‘real’ or physical economy of products and services” and the other is a “financial economy of money and credit”. Workers in the financial economy were spending all their ‘hard earned’ cash in the physical economy, propping it up whilst low income wages were suppressed.

Many, especially those who voted to remain in the EU, argued that this was good for the economy. And they weren’t wrong. On the surface it was good for the economy but it was hiding all the underlying weaknesses due to rising ECoE, merely kicking an ever enlarging can down the road. And what is good for the economy (or the perceived economy) is not necessarily good for its citizens (or majority of its citizens). Citizens outside of the financial economy were left with suppressed wages along with worsening services due to a rapidly increasing population. Schools were full, appointments with the doctor were impossible to obtain, hospital waiting lists got longer and longer, the list can go on and on. And (some) people wonder why 17.4 million voted were cast in 2016 to Leaving the EU…….

(On a side note, some conspiracy theorists liken mass immigration to the West to the Kalergi Plan. This plan is described on Wikipedia as “a racist conspiracy theory which alleges that Coudenhove-Kalergi intended to influence Europe’s policies on immigration in order to create a “populace devoid of identity” which would then supposedly be ruled by a Jewish elite”. Others say the plan is to introduce a large group of fighting aged men in case the population needs controlling. Personally, I think mass immigration is for the economic reasons detailed above. However, it isn’t beyond the realms of possibility to think that some military bod has in the back of their minds, that a dependent group of working aged men are grouped in hotels up and down the country might come in handy if the sh*t really did hit the fan.)

But even this charade, where half the population were prospering, couldn’t last for long. 2008 exposed the fact that even the financial parallel economy was a farce. And since then, it too has stagnated. Only an elite few are prospering. Generally it will be those connected somehow to the core of the financial economy, whether it be bankers themselves or the companies e.g. law firms and accountants, directly servicing them. Even professionals outside of this parallel economy are no longer prospering. Go to any town and unless a job is connected with the City of London, households’ standards of life will be dropping. In the past a professional single earning household could have scrimped and saved to send two or three kids to private school, all whilst enjoying a yearly holiday abroad and with the mother staying at home. Now, I hear the moans from doctors, solicitors, accountants, and pilots all the time, “my parents could afford to send me and my siblings to private school but there’s no chance of me doing the same. I don’t understand it, I have a better job than my father and my wife works full time, yet we still can’t afford the same things”.

This is what leads me to believe the ECoE is correct. There is clearly a huge decline in prosperity.

It’s Economics 101 that when a government prints its own currency at will, by issuing bonds, it has to be backed up by projected tax income. When prosperity in a country is declining, this tax projection will inevitably be wrong, leading to bond market collapses (and in an import-dependent economy like the UK, huge inflation). In another article, I shall (if spared) shows how the money printing impoverishes the many via the Cantillon Effect. This simple idea shows 1) those who print new money benefit from it most. 2) Those who get this new money from them fastest benefit nearly as much. 3) Those who get it last are the ones most harmed.

“the reason is obvious: when you spend newly created money, you get to buy at the prices from yesterday. you are the new demand and the new spending. you are what starts to cause inflation. but you don’t face it like others will. you’re the one driving up the prices for the next guy. he pays for your profligacy.

and this not only causes all manner up upward pointing wealth redistribution based on proximity to the money spigot, it destroys the fundamental aspects of price and markets that make them free and useful allocators of scarce resources.”

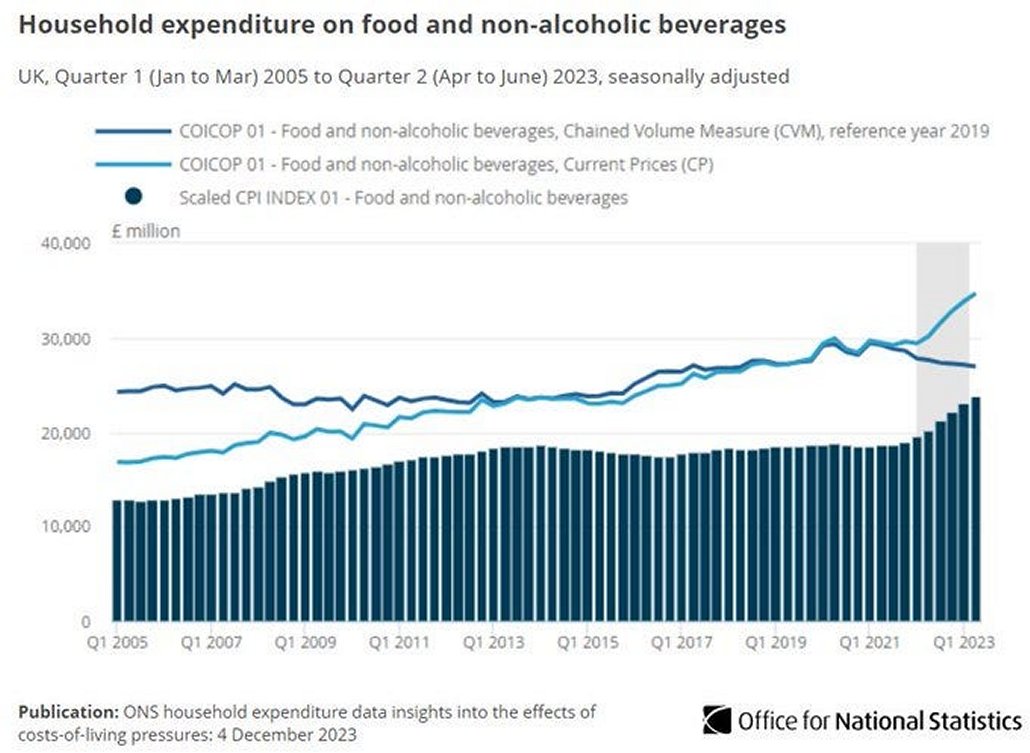

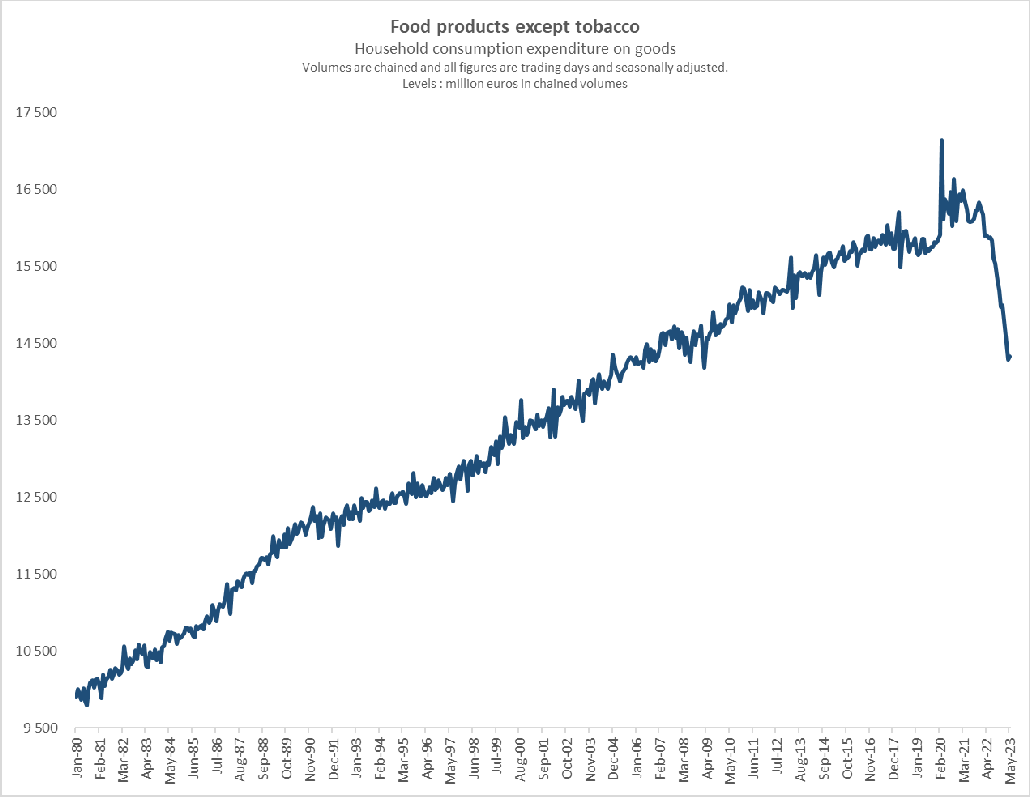

In the UK we are already starting to see the effects of money printing, inflation and a decline in prosperity with the bankruptcies of major cities. Birmingham City Council went bankrupt last October, shortly followed by Nottingham council. Reportedly, nearly one in five councils are at risk of bankruptcy so expect more to follow as we progress through 2025. We are also seeing this in household expenditure. According to the Office for National Statistics (ONS), household expenditure rose by £5.1billion (17.4%) in nominal terms. By contrast, real expenditure on food fell by 5.8%. The conclusion is that households changed their behaviour, eating less food, or switching to lower quality food, whilst spending more.

This can only carry on for so long before people start to revolt. It is already much worse in some other countries, such as France.

And that is why the rise in ECoE makes sense, why else would this be happening across the West?

And as I said at the beginning it explains a lot of geopolitical events of late. If the theory is correct, countries will be desperate for cheap energy and we’ll see a lot more wars to get it. At the same time, governments don’t want their populace to riot so they are nudging them. Whilst they can’t prevent the decline in prosperity, they can prepare their citizens mentally. They can nudge you into thinking that you didn’t really want to go abroad on holiday. You didn’t want a nice car because it causes climate change. You didn’t want children and a nice house because we need to save the planet. Nudge, nudge, nudge. Nudging you to accept your decline in prosperity instead of realising the real reasons behind it.

If the rise in ECoE theory is correct we will witness an ever increasing number of major geopolitical events as the powers-that-be try to manage the decline.

© DJM 2025