Previous articles in this series have focused heavily on coins. This time I take a look at the history of bullion, ingots and bars for a change.

What is Bullion?

Claude de Bullion, became the French Minister of Finance in 1632 under King Louis XIII. He was an extremely rich man and so great was his wealth that the generic term of ‘Bullion,’ emerged after his name and came to symbolise untold wealth. He was not a popular man in France and following his death it was necessary for him to be buried at night time to avoid a baying mob. One hundred years later his reputation for excessive wealth had not diminished and during the French Revolution his tomb was raided and destroyed.

Philippe de Champaigne, Public domain, via Wikimedia Commons

Gold and Silver has been traded for over two thousand years, particularly by the Spanish, captured from their conquests in South America during the middle ages. Bullion value is based on the purity, mass and weight of the commodity being sold and these metals could be in the form of coins, ingots and bars.

The world’s trade in bullion is based in London and their standards are considered to be the benchmark for quality and safe delivery of gold and silver bars whatever their origin. The Bullion Market is where the wholesale trading of gold and silver is undertaken. The London Bullion Market Association coordinates the activities of its members and other market participants and promotes quality standards and fineness to ensure that gold bars traded are 99.5% pure and silver is 99.9%. This regulated trading ensures that [in theory] standards are maintained and fairness prevails for buyers and sellers wherever they are located.

History of ingots & bars

Gold bars have a long and interesting history. The earliest type of gold bars were ingots made from pouring molten gold into moulds, most probably initially made from clay. Reference is made to an early type of ingot by Roman author Tacitus, who mentions a “tall story” told by one Cesellius Bassus to win the favour of Emperor Nero. Bassus claimed to know the whereabouts of “immense stores of gold, not wrought into the form of coin, but in rude and shapeless ingots, such as were in use in the early ages of the world.”. The gold was never found, but the tale illustrates that in pre-Roman times, an ingot was a known commodity, but one that might not necessarily have been “bar shaped”.

Although in modern times, most of the world’s gold is mined in Africa, it was not always so: During the 18th century, Brazil was the foremost gold producer. Most of the gold that had been mined came to London – and there are a number of references to “gold bars” in the literature of the period. However, these sources typically do not mention the size or purity of the bars, merely the total value of the bullion. This itself is an indicator that in those days the gold bars may well have been of non-standard size – and this seems likely seeing as that they were melted and poured into moulds, rather than pressed.

The Bank of England created the first “official” gold reserves and had gold minted into guineas – which were the standard gold currency coin of the day. Towards the end of the 18th century however, gold became scarce and much was either exported or used to finance military operations.

A gold bar is defined as any gold product made by a recognised bar manufacturer, regardless of shape. On the bar is recorded the name of the manufacturer, the exact weight and purity. A gold bar is sold with a premium above the value of the gold at the time of sale. The amount of this premium is dependent on the size of the gold bar. The larger the bar the less the premium in proportion.

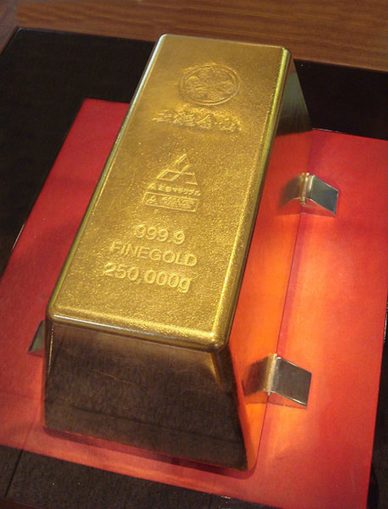

Gold bars are measured in troy ounces and purity is measured as karats (not to be confused with the carats of diamonds) and come in weights up to 400 ounces (although the world’s largest gold bar, produced by a subsidiary of Mitsubishi, weighs in at 250kg).

PHGCOM, CC BY-SA 3.0, via Wikimedia Commons

There are just 55 refineries in the world today who manufacture 400 ounce gold bars acceptable internationally and these are known as ‘London Good Delivery’. Some leeway is given in the weight of a 400 ounce gold bar which can actually weight between 350 and 430 ounces. The purity must be 99.5 percent or more. It is estimated that about 150,000 of these bars are made each year although it is likely to be more than that. Most banks that store gold do so in this form and are believed to hold somewhere around 2.5 million of them.

The 1000 gram (kilobar) is the bar that is more manageable and is used extensively for trading and investment. The premium on these bars when traded is very low over the spot value of the gold making it ideal for small, transfers between banks and traders. Most of the kilobars are flat although some investors in Europe prefer the brick shape bar. Smaller one ounce, ten ounce, one kilo and even ten kilo bars are favoured by smaller investors as easier to buy even though the premium on the bars are higher.

Buying Bars

As with coins, there are plenty of precious metal traders who you can purchase bars from, in addition to sites such as Ebay, Facebook and Gumtree. Personally, I would only buy from official and trusted sources as there are too many stories of people being scammed out of their money by buying fakes.

The Royal Mint and Baird & Co make their own gold and silver bars and it’s quite common for bars made by overseas mints such as The Perth Mint (Australia) and Metalor and PAMP (Swiss) to be sold by dealers based in the UK.

Bars come in various weights; from 1 gram up to 100 grams in gold and from 1 ounce through to 100 ounces (circa 3.1kg) for silver. As a rule of thumb, the heavier the bar the less the cost per gram (or ounce) will be.

Bar Designs

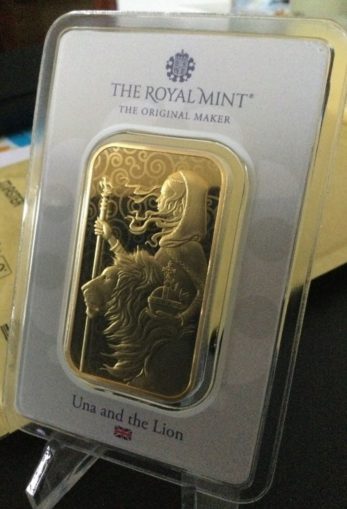

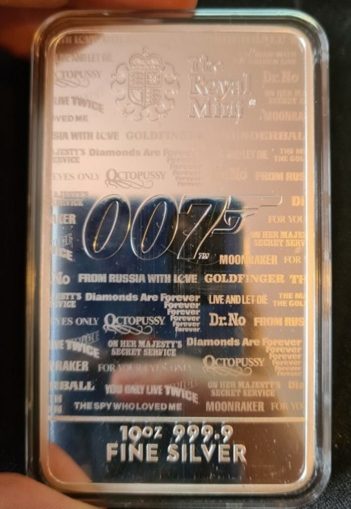

Before researching the whole precious metals subject, I thought that all gold and silver bars were fairly plain and there wasn’t much variety. How wrong I was. For example, the Royal Mint has started producing gold and silver “Britannia” design bars as well as a James Bond themed bar and another one in the Great Engravers Series (Una & the Lion).

The Perth Mint in Australia also has a history of producing gold and silver bars in beautiful and interesting designs such as this dragon design.

Officially the Perth Mint Dragon bar is classified as a ‘coin bar’ as it has a denomination and is to all extent and purpose a rectangular coin.

Many of these types of bars are produced in limited numbers, which appeal to the collector market. For example, the Una & the Lion Bars (all now sold out) were produced in the following metal and mintages:-

| Metal | Weight | Mintage |

| Gold | 1 Ounce | 4,000 |

| Silver | 1 Ounce | 35,000 |

| Silver | 10 Ounce | 6,100 |

| Silver | 100 Ounce | 1,020 |

Each of the bars in this collection come at a premium over plain bars, however due to the limited numbers produced it is anticipated that their values will rise in the secondary market, particularly for the lower mintages.

Pros and Cons of Bars

Looking first at gold bars, there is no VAT to pay on gold, whether buying bars or coins, however when it comes to Capital Gains Tax (CGT) coins are exempt because they are legal tender, whereas bars are not. This would only become an issue if you are selling a large amount of gold at a profit or the rules on CGT change in future.

When it comes to silver, the same rules apply with regards to CGT but silver is not VAT exempt and will be added to the price you pay for the bar (same with coins), unless you are buying second-hand silver.

If you are buying larger weights of gold or silver the size of the bar may also present a problem when it comes to storing them, whereas most coins are relatively small by comparison and can be separated and hidden with greater ease.

Even so, there is little doubt that a bar of gold or silver appeals in a way which a coin does not and a bit of diversity can sometimes be a good thing (Who knew?).

The Real Goldfinger – Part 2

Some of you may recall my article on “The Real Goldfinger?” published on Tuesday this week. My research into Charles Engelhard further led me search auctions to see if any examples were for sale. I was delighted to find a 1 kilo silver bar produced by their London refinery listed for sale and I’m subsequently pleased to report that I now have it in my possession.

Apparently, bars made by Engelhard are highly sought after and mine is one of only 6 other bars known to exist in this format and with a ‘K’ serial prefix. As such it can command a premium over and above the spot price of silver. I contacted a group who specialise in cataloguing all known examples of silver bars made by Engelhard and they have informed me it is pretty rare and could be worth about double what I paid for it, to the right collector.

Featured image: “Crowne-Gold-Silver-Bullion” by digitalmoneyworld is licensed under CC BY 2.0

© text & images except where indicated Reggie’s Mind Of Evil 2021

The Goodnight Vienna Audio file