“World bankers, by pulling a few simple levers that control the flow of money, can make or break entire economies. By controlling press releases of economic strategies that shape national trends, the power elite are able to not only tighten their stranglehold on this nation’s economic structure, but can extend that control worldwide. Those possessing such power would logically want to remain in the background, invisible to the average citizen.” — Aldous Huxley

“In fact, if you’ve got a moment, it’s a twelve-storey crisis with a magnificent entrance hall, carpeting throughout, 24-hour concierge & an enormous sign on the roof saying “this is a large crisis”……. And a large crisis requires a large plan” — Edmund Blackadder

US federal regulators moved swiftly recently to crush several banks tied to the crypto industry, one after another. Within days, Silvergate and Signature Bank – the two banks that most aggressively facilitated payments into and out of the crypto universe – were effectively defunct. Silicon Valley Bank, which catered to the venture capital firms who regularly fleeced retail investors through various crypto proxies during the height of the mania, was also in the hands of the Feds, having been seized during business hours on Friday. The subsequent demise of Signature was especially stunning, as was the matter-of-fact way in which the news was announced on Sunday evening:

“We are announcing a systemic risk exception for Signature Bank, which was closed today by its State chartering authority. All depositors of this institution will be made whole. As with the resolution of Silicon Valley Bank, no losses will be borne by the taxpayer. Shareholders and certain unsecured debtholders will not be protected. Senior management has also been removed. Any losses to the Deposit Insurance Fund to support uninsured depositors will be recovered by a special assessment on banks, as required by law.”

Many insiders were shocked by the cold-blooded assassination of the bank, as was Barney Frank, a one time bank regulator. According to him, “Signature executives explored ‘all avenues’ to shore up its situation, including finding more capital and gauging interest from potential acquirers. The deposit exodus had slowed by Sunday, he said, and executives believed they had stabilized the situation. Instead, Signature’s top managers have been summarily removed and the bank was shuttered Sunday. Regulators are now conducting a sales process for the bank, while guaranteeing that customers will have access to deposits and service will continue uninterrupted. ‘I think part of what happened was that regulators wanted to send a very strong anti-crypto message,’ Frank said. ‘And Signature apparently had a target on its back because there was no insolvency based on the fundamentals.’”

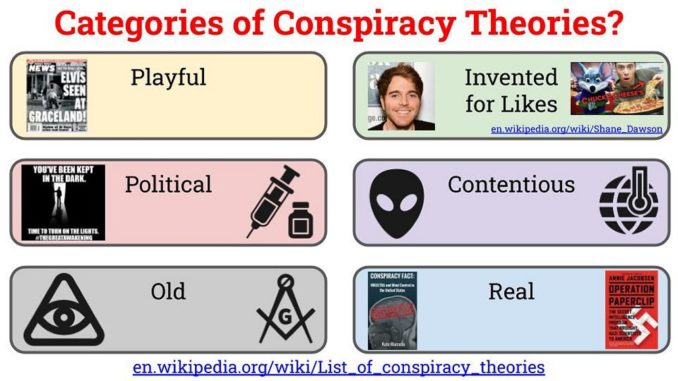

Make of that what you will, but while the immediate consequences of these events are still being sorted, many have spent the past few days pondering the longer-term fallout for crypto. What does the future hold for the industry, and which dominoes are next likely to fall ? It’s “don the tin foil hat time” again, Puffins …………. With the financial situation in the West teetering on the edge of a major crisis, we ask ourselves – Did we get here accidentally ? And if not, what is the agenda behind it ?

Well, firstly, no, it’s not accidental. Let’s get that out of the way. But does that mean the collapses were planned and engineered to the last detail? Maybe, maybe not…. but there was at least some warning for “people in the know”. SVB’s CEO and CFO sold a combined U$4 million of their own stock in the two weeks before the crash, and Peter Thiel’s Founders Fund withdrew all their funds the Thursday before the collapse. Also, it should be noted that the California Department of Financial Protection and Innovation found that SVB was a “sound financial institution” as late as March 9th 2023, and that it only entered insolvency after investors caused a run. Obviously, that’s not proof of an intentional collapse, but it’s something to make a note of nonetheless. Anybody with some kind of foreknowledge could have made a fortune in put options in the days before closure. Now some might be in favour of addressing the problem of crony capitalism in a direct, robust manner,

But all of that is irrelevant, really, because we know the world economy has been deliberately trashed for three years as a response to “the pandemic”. In consequence the cost of food and energy has spiraled well beyond the fundamentals & the value of currency has been tanked by “printing” billions upon billions of dollars, pounds, and euros. So, even if there was no specific micro-managed set-up with specific banks, bank failures were the inevitable result of this economic vandalism – both inevitable, and desired.

Since 1971 gradually, & from 2008 inexorably, America’s fiat fractional reserve system has morphed into a faith-based credit system, and the people who use the dollar are losing confidence in a system that relies entirely upon their complete and total trust. Should collective faith in the system continue to decline, the American ruling class will decide that their path forward involves re-grasping full control of their confidence scheme through the implementation of a Central Bank Digital Currency (CBDC).

So…….what habbens nows ?

Well, one aspect will be tighter regulation – specifically of cryptocurrency – It’s likely no accident that two of the failed banks – Silvergate and Signature – were major investors in crypto, and SVB was known to have links to crypto too. The narrative will likely come about that “unregulated crypto investment poses a danger to the financial system” or that “unregulated crypto makes our financial institutes vulnerable to economic warfare” or something similar. The next phase will likely be arguing that small, private banks cannot guarantee the security of their customer’s money, and it would be safer for individuals to bank with either giant international banks or directly with the central bank. It’s already being reported that Bank of America saw a huge boost in deposits post the SVB crash. This process of consolidation in the major banks is likely to continue. Logically, there’s only one place this two-pronged propaganda is headed…………

“When a group of men who live in a civilization adopt plunder as a way of life, they eventually build a legal framework that permits it and a moral code that elevates it.” — François Bastiat (1801–1950)

Going forward, CBDCs will be posited as more secure than traditional banking, and more regulated than “traditional” crypto. Further, since the FDIC is now fully guaranteeing deposits in failed banks, in the US you’re practically banking with the Fed anyway. Why not just cut out the middle man? These arguments are known, because they already on record. Back in January this year, the World Economic Forum published a paper titled: “Can central bank digital currencies help stabilize global financial markets?” so it’s clear what the sales pitch was going to be. But more than that, it’s possible bank runs will actually be encouraged…….. even engineered in future, because they could increase the uptake of digital currency.

According to a report from the Bank for International Settlements [emphasis added]:

“Another set of studies focus on the risk that a CBDC may increase depositors’ sensitivity to system-wide banking crises by facilitating the transfer of deposits. The availability of CBDC might not have a large impact on individual bank runs as it is already possible to digitally and instantly transfer money between a weak and a strong bank. However, during a systemic banking crisis, transfers from bank deposits into CBDC would face lower transaction costs than those associated with cash withdrawals (such as going to the ATM, waiting in line, etc.), and would provide a safe-haven destination in the form of the central bank. The lower costs of running CBDC compared to cash imply that more depositors would quickly withdraw at a lower perceived probability of a system-wide bank solvency crisis.”

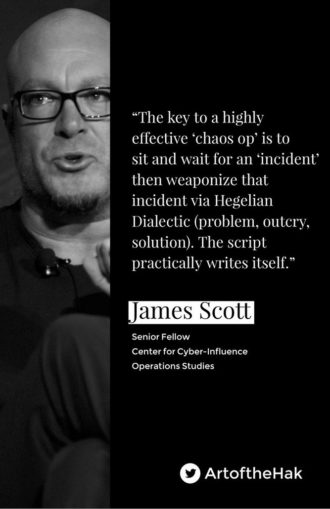

There’s a clear implication here……… Once CBDCs are out there – optional at first, of course – the central banks could theoretically increase uptake by artificially engineering financial instability and causing regional banks to collapse. Initially, they won’t have to make it mandatory, they’ll just make it “safe”. Another report published in 2022 by the House of Lords, described CBDCs as “A Solution in Search of a Problem”. It looks like they just found their problem. And problems are just like everything else – the best are the ones you make yourself…. in this case an almost perfect example of the Hegelian Dialectic : The problem is created to obtain the reaction required, people will accept the solution on offer – and if they’re really scared, they’ll beg for it….

But just how do you get people to take their money out of banks in droves and put it into the new approved CBDC ? By making it look too dangerous for them to stay with the existing banking system. Keep people unsettled & nervous, but offer the carrot of a 100% safety guarantee on deposits. But a U.S. CBDC would do much more than simply implement a fully digital version of the U.S. dollar. The system would ensure a custom built, unlimited digital toolkit to be available for unaccountable bureaucrats to surveil, censor & impoverish citizens, whilst at the same time as advertising itself as making the system more “efficient” and helping to deliver monetary power to the unbanked. In a nutshell, the implementation of Central Bank/Government digital currency will mean they really, truly, control the economy. It will mean that funds can be taken right out of your account or fine tune what you are allowed to do with it. It means they can decide if you are allowed to spend it and if so, on what. It means they will have instant knowledge of all your transactions. It will mean the end of privacy, & the primacy of the individual.

In recent weeks, Wall St and Washington have been backed into a corner, America is now faced with the prospect of a burgeoning financial contagion, and financial markets are showcasing global ramifications. Despite endless reassurances from the Biden Administration’s Treasury Secretary that the system is safe and secure, the American people are beginning to doubt the narratives being promulgated by the ruling class. The vast majority of American banks are now incredibly exposed, and the Biden Administration has already signaled that only the major banks will receive the backing of FDIC insurance beyond the $250,000 per depositor limit. Now, for the people in charge, a Chinese Communist Party-like CBDC is becoming the “emergency” solution to restore their positions in the societal and monetary hierarchy. It does appear we are entering a consensus period that involves moving full steam ahead with the CBDC project. This “emergency” CBDC will inevitably become their “final solution” to the crisis that our elite Central Banking Class have fomented since 1971 with their destructive monetary Ponzi scheme.

Predictions for the Puffinati through 2023 & beyond

- The financial system will continue to implode as inflation remains high;

- With another – as yet unknown – “crisis”, we will be told that the whole system will fail but that CBDCs will stop that or come to the rescue after it has happened;

- Propaganda will be used to make people cry out for CBDCs, digital IDs, and a Universal Basic Income;

- The digital ID/CBDC system will be introduced, incorporating the vaccine pass infrastructure. Too much money & top table influence has already been “invested” in the digital VP for it to be set aside.

Buckle up, Puffins……… Brave New World incoming.

© DJM 2023